Beginning Cash

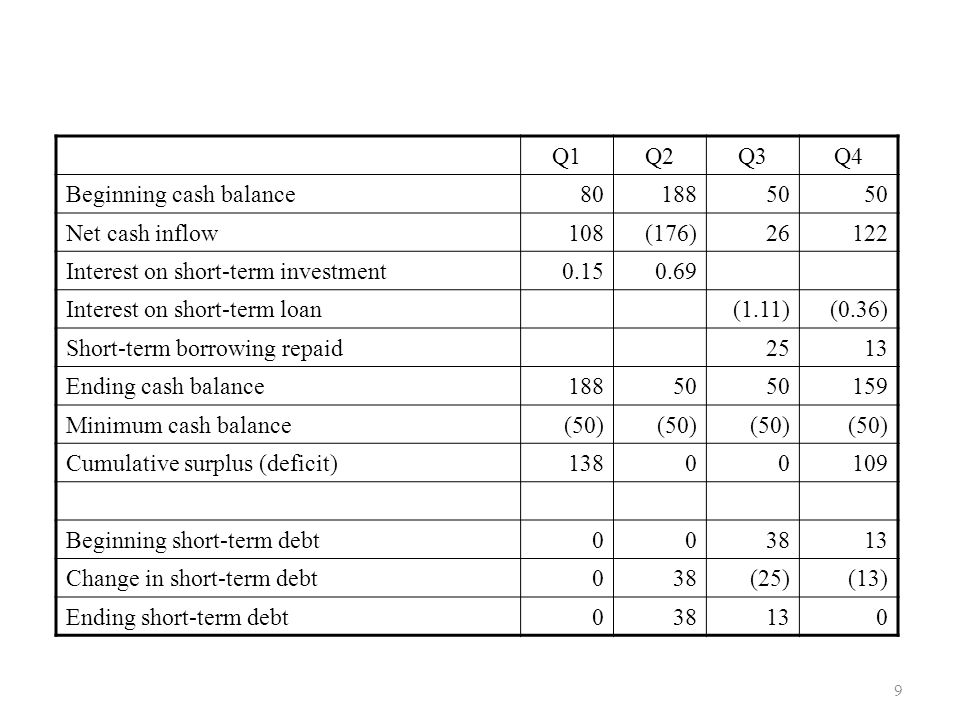

Because of the cyclical nature of cash flow, the beginning cash balance is simply the ending cash balance from the previous cash flow statement. This means that the process and formula for computing a beginning cash flow is the same as the process for determining an ending cash flow, only viewed from different time perspectives. Accountants use cash flow statements to find ending balances and track changes in cash balance along the way, but in doing so they are also calculating beginning balances for future accounting periods. Cash flow statements reveal balances through simple additions and subtraction. The basic formula for calculating or checking a beginning balance is the ending balance, plus all cash outflow, minus all cash inflow.

Cash Flow from Assets = Cash Flow to Creditors + Cash Flow to Stockholders CFFA = Operating cash flow – net capital spending – changes in net working capital. WELCOME TO SUMMER EBT FOR CHILDREN. The State of Michigan is proud to be one of the states awarded funding for the Summer Electronic Benefit Transfer for Children. What is the beginning cash balance for the budget period, January 2009? (Use the following data to answer this question). Table Balance sheets for American Construction, Inc. Table 2- Income statements for American. Question 6 options: A). Show transcribed image. The Investor Relations website contains information about AmTrust Financial Services business for stockholders, potential investors, and financial analysts.

Gary Grigsby S War In The East Serial Number. The formula for a beginning balance for a future accounting period is the beginning balance of the past period, minus all cash outflow, plus all cash inflow. In a cash flow statement, cash inflow refers to money received from the sale of assets, the sale of goods and services, investment interest, stock dividends, and the sale of equity, or stock. Cash outflow includes payroll expenses, taxes, payments for raw materials or inventory, loans offered to others and stock dividends paid to investors. When an investor or analyst reads a cash flow statement, the beginning balance has limited significance. Instead, information about a company's financial position comes from the difference between the beginning cash balance and the ending cash balance. When a business is founded, its initial cash flow statement begins with its cash balance, or the money it has, in cash, ready to spend. Beyond this point, cash flow statements represent only change in cash balances.

An increase between the beginning cash balance and the ending cash balance simply means that the company spent more in cash than it took in. Download Game Biko 3 Full 1 Link. If its cash balance is well above zero, then the important question becomes what the business spent its cash on and whether those expenditures were worthwhile.

Comments are closed.